Ok. I know. The only thing more boring than insurance is talking about contracts, but we really need to discuss this. So listen…please. As a general contractor, you work with many independent subcontractors. If you’re smart, you have written contracts with each. If you’re really smart there’s a hold harmless agreement in those contracts that says something like “subcontractor shall indemnify, defend and hold harmless general contractor against all claims for property damage, bodily injury, including death, losses and expenses, including but not limited to attorney’s fees, arising out of or resulting from the subcontractor’s sole or partial negligence…” If you don’t use hold harmless agreements, I feel sorry for you. If you don’t have written contracts with every sub and require them to name you additional insured on their policies, then I’ll pretend I don’t know you if we bump into each other at a trade show. I mean, you know the world today! Ronald Reagan said “in God we trust. Everyone else must verify.” He was right. Time for a story...

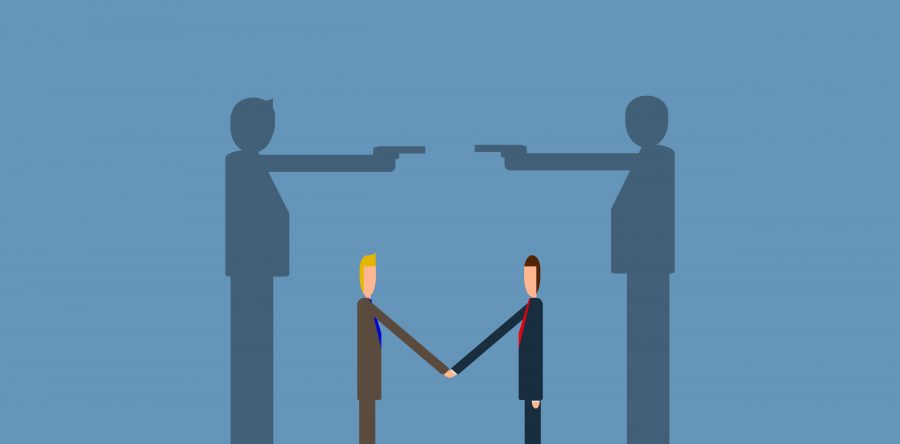

Joe G. Cee has worked with Thomas E. Dison Electric a long time. They went to the same high school, dated the same girl, who Tom married, but no hard feelings, especially after the divorce (but I digress). The point is Joe and Tom have been through life and the home building industry from highs to lows, through thick and thin. They trust each other. In an earlier, simpler and now bygone era, their word was their bond. A handshake sealed the deal. They never had a written contract through 25 years and 100+ homes built. No third party claims either. Until one day…

Joe gets a frantic call from Tom. “I’ve just been sued!” Says Tom. “Remember that fire at 123 Maple Street?” “No.” Says Joe. “It was in the news last week. The home owner’s five year-old daughter is in critical condition.” Joe begins to get a creepy feeling. “I built that house two years ago, didn’t I?” He asks Tom. “You sure did.” Answers Tom, “and I wired it. The suit papers say the fire was my fault.” The next day Joe is served suit papers too. He contacts an attorney who asks for his contract with Tom. Joe tells of his long history with Tom. His attorney sounds worried, but says he’ll do the best he can. Because Tom did not hold Joe harmless, Joe is drawn into the suit for the little girl’s injuries. Those injuries are life changing. She’ll need multiple surgeries over the next 10 years. The cost of her ongoing treatment will easily exceed Tom’s liability policy limit. Joe’s policy will have to pay too. There could also be a demand or judgement in excess of Joe’s liability limit. His business, or even personal assets could be at risk. Not only that, because Joe was not named additional insured on Tom’s policy, Tom’s insurance company will not defend Joe.

Because this was Joe’s first liability claim ever, luckily his insurance company is willing to renew, but at a much higher price. Joe’s agent explains the extra premium is due to Joe’s practice of relying on handshake agreements. “But, it’s worked for 25 years!” says Joe. His agent sighs and says, “the world’s changed, Joe.” Joe’s attorney advises him to get signed contracts containing hold harmless agreements with all his subs and to not work with anyone who will not name Joe additional insured. Worst of all, Joe and Tom barely speak to each other now.

Do you have contracts with your subs? Do they hold you harmless? Are you named additional insured on their policies? Joe was not responsible for the defective wiring that caused the little girl’s injuries. Yet Joe was held responsible because he was not held harmless.

Don’t trust in luck and handshakes when the survival of your business may be at stake. Call us today at 1-866-454-2156 to review your general liability coverage needs.* Or, click here to inquire by email. Looking for a no obligation price indication? Click here.

*(This article is not intended as legal advice. Its purpose is to discuss the possible liability insurance implications of failing to have your subs sign contracts with hold harmless agreements. The author is not an attorney. You should consult an attorney when discussing the particulars of all contracts.)